Weekly Systematic Trading Update

Week ending December 12, 2025

Uncertainty in the capital markets increased due to conflicting signals from economic policy but also geopolitics. Stocks remain at elevated levels due to the expectation of lower rates, but the fixed-income market is closely monitoring the increasing odds of the Fed losing its independence in executing monetary policy.

Large-cap stocks (S&P 500 index) fell 0.63% this week while the 10-year yield rose five basis points to 4.19% despite an interest rate cut. Precious metals surged but ended the week off their highs. Spot gold and silver gained 2.5% and 6.2%, respectively, while the US dollar index fell by 0.6%.

Many analysts on social media and in the blogosphere are trying to forecast market moves and even returns for next year. Although some of those analysts may have experience and a favorable track record, the overwhelming majority are victims of confirmation bias and lack of understanding of the complexity of the subject that often renders forecasts random. Whereas developing robust systematic strategies is a tedious process that requires several skills, most of those forecasts are effortless narratives and only sound impressive due to the use of fancy terminology. The majority of forecasters cannot beat a simple momentum strategy based on price series momentum over the long term. However, because laypeople are drawn to narratives, these forecasters attract a large following. Some forecasters try to add quantitative flavor to their narratives, but those with quant skills can see they don’t understand the mechanics and application. When used in a systematic context, quantitative analysis makes sense; otherwise, confirmation bias prevails.

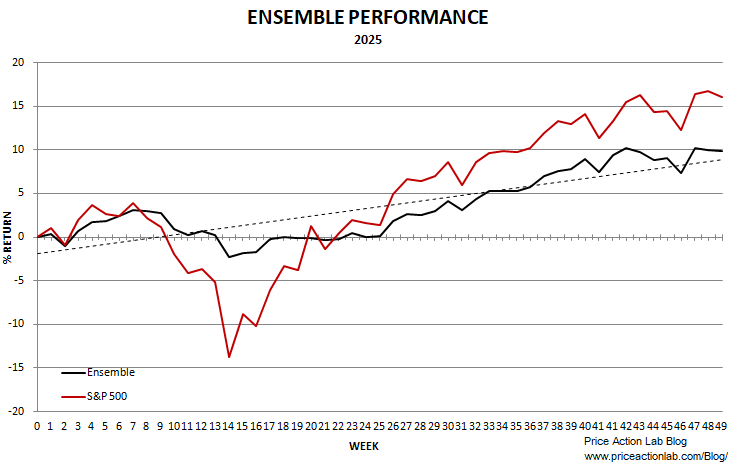

This week, ETF cross-sectional momentum gained 1%, and mean reversion for Dow-30 stocks ended unchanged, while the remaining strategies with open positions fell slightly. The ensemble has gained 9.9% year-to-date, with a maximum drawdown of 5.2%, compared to a 16.1% return for the S&P 500 index, at a 17.1% maximum drawdown. The ensemble does better than the benchmark when taking risk into account, which is the main goal: the ratio of the return to the maximum drawdown is 0.94 for the benchmark, while for the ensemble it is 1.9 because it has a lower beta.

Disclaimer: The past performance of any trading system or methodology is not necessarily indicative of future results.

Agreed on the problem of the attractiveness of "narratives" to many, rather than a momentum-based approach. "Tell me a story" is fine but limited.

I’m a big fan of momentum, but I’m curious as to what your definition of momentum is?

I tend to think shorter term momentum in thematic names that often have some “cluster” effect to it, or herd effect is the most interesting, I also think there is momentum now attributed to market expectation adjustments and so forth, but I don’t think I’ve seen a good momentum definition, at least there are academic definitions but they never seem to account for mean reversions either. Curious on your thoughts as to what is good momentum vs bad?