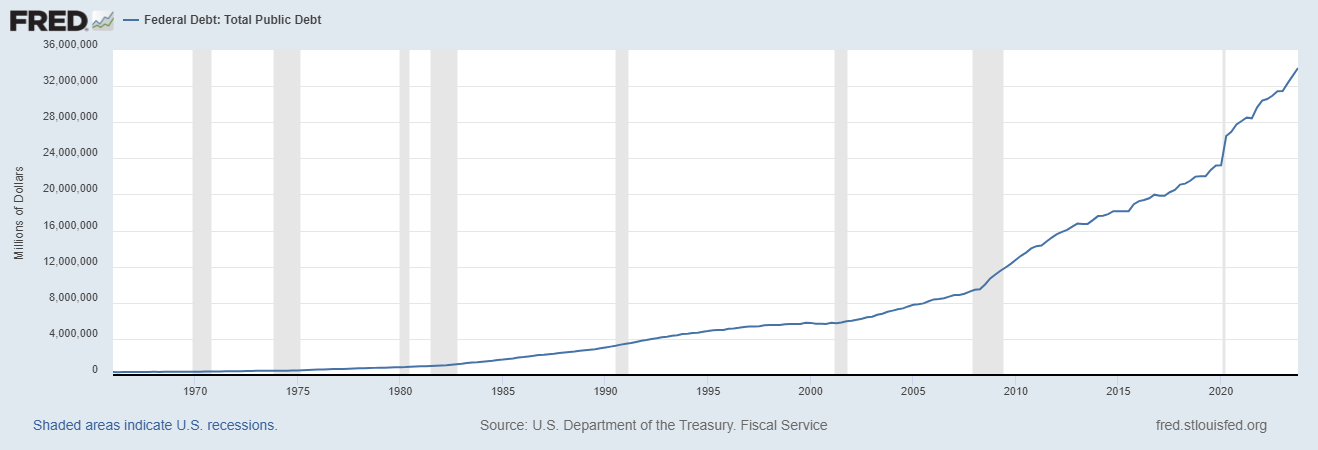

The US public debt has exploded to more than $34 trillion and is rising at a rate of one trillion every 100 days.

The explosion in US public debt is due to the US economy financing not only its own growth but, more importantly, worldwide growth due to the US dollar being the reserve currency used in international transactions and the guarantor of financial and geopolitical stability. However, the current rate of increase in debt is not sustainable, according to economists and market analysts. If the United States loses its status as a financially stable economy, then there is a risk of worldwide economic collapse and financial chaos. Everyone around the world who is sane wishes the US economy remained strong.

The gold standard was in place since 1879 and facilitated a stable economic environment until the Great Depression, when the public and businesses started hoarding gold and the government was unable to stimulate the economy due to a plunging money supply. The solution in 1933 was to prohibit transactions in gold, order the public to exchange it for fiat money, and inflate the money supply by setting a price for gold at $35 an ounce. This prevented a secular depression and allowed the government to execute policies for a recovery. The gold standard was finally abolished on August 15, 1971, when the convertibility of fiat to gold was terminated and the US dollar became a free-floating currency. This was the first great reset and the beginning of the worldwide dominance of the US financial system and technology, the dominance of capitalism, and the start of the collapse of socialism. In essence, abolishing the gold standard led to the defeat of socialism.

It goes without saying that politicians all over the world abused the new fiat money printing system, which has resulted in an unsustainable increase in public debt. A number of countries have had hyperinflation due to the abuse of the power of money printing. Due to quantitative easing policies, the public debt in the USA started increasing at a faster rate after 2010. The rate of increase in public debt moved even higher due to the pandemic stimulus in 2020 and, as shown in the above chart, there is no indication of this process slowing down. This is not a sustainable process, and at some point there will be a debt crisis, yields will start rise, equities may crash, and financial chaos could ensue. The solution could be a new great reset based on a dual central bank digital currency (CBDC) and a gold standard (GS).

The CBDC-GS dual system will allow governments complete control over spending in a low-inflation environment. Activities that are not contributing to growth or are inflationary will be harshly penalized. It will be a return to the pre-1933 gold standard system with the aid of technology and real-time monitoring. Probably, the public will not be allowed to own gold in physical form, other than maybe jewelry. Due to the precious metal's limited availability, a CBDC with gold as collateral will facilitate a low-deflation process. But why not use bitcoin, which has embedded scarcity? The problem is that governments do not have control over bitcoin and its whales, plus the new system must be under central control. Will they ban bitcoin? Probably not, because it will not be easily convertible to a gold-backed CBDC. Bitcoin will be used in certain transactions, in the form of barter trading, but will have limited use. Whether the value of bitcoin will increase or decrease in such an environment is debatable, as both scenarios depend on conditions that are unknown at this time.

What is the timeframe of the new great reset? No one can really tell. Nowadays, things happen faster due to technology. I could be after 10, 20, or 30 years, or even next month. The governments already have the infrastructure in place everywhere. Technology is moving rapidly. During the pandemic, all the systems for monitoring and control emerged in a few months. The new artificial intelligence makes it possible to develop large-scale systems in a matter of weeks/months.

It is likely that one day we will all find out that the world is no longer what we were used to. No one will ask our opinion. But more importantly, no one knows whether it will be for the better or worse. Let us hope it will be for the better, for humanity, or for the new transhumanity that will emerge.