Stock market momentum faded out after the irrational exuberance of the 1990s. Many analysts and academic researchers did not anticipate the regime change after the dot-com bull market top. Although trend-following still works in the stock market for the long side, the returns are not what they used to be. However, momentum has nearly disappeared.

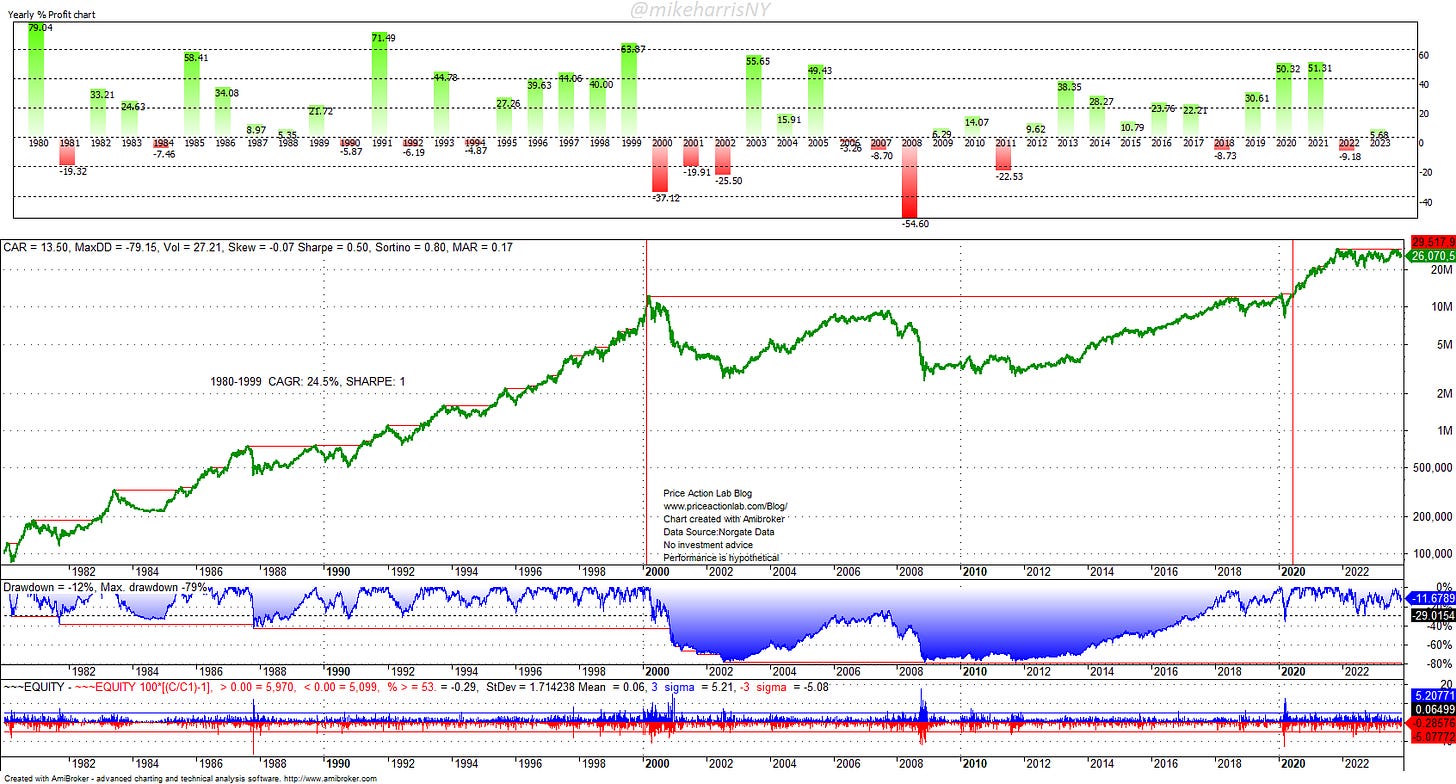

I used historical data series for the S&P 500 index constituents from Norgate Data, which includes delisted securities, to remove survivorship bias. I backtested a simple system that invests at the end of every year in the 10 stocks with the strongest performance and keeps them for a year. Below are the results of the backtest.

From 1980 to 1999, this simple momentum strategy had an annualized return of 24.5% with a Sharpe ratio of 1! That was good enough to fool many analysts and even academics. Note that the t-statistic for this performance is about 4.5, and that points to a statistically significant result assuming no multiple comparisons.

However, after 1999, the performance deteriorated amid rising volatility, and it was not until after 20 years that the equity high of 1999 was recaptured.

What happened? There was a regime change, and the simplest explanation is that the trade got crowded. Before 1999, the maximum drawdown was about 40%, but in 2008, it reached as high as 79%. Since about mid-2021, the performance of the strategy has been flat.

We can play with the parameters and fit the strategy to the historical data for better performance. We could also add filters and more indicators. But this is data-snooping bias, and it is what is usually done in an effort to prove that momentum still works.

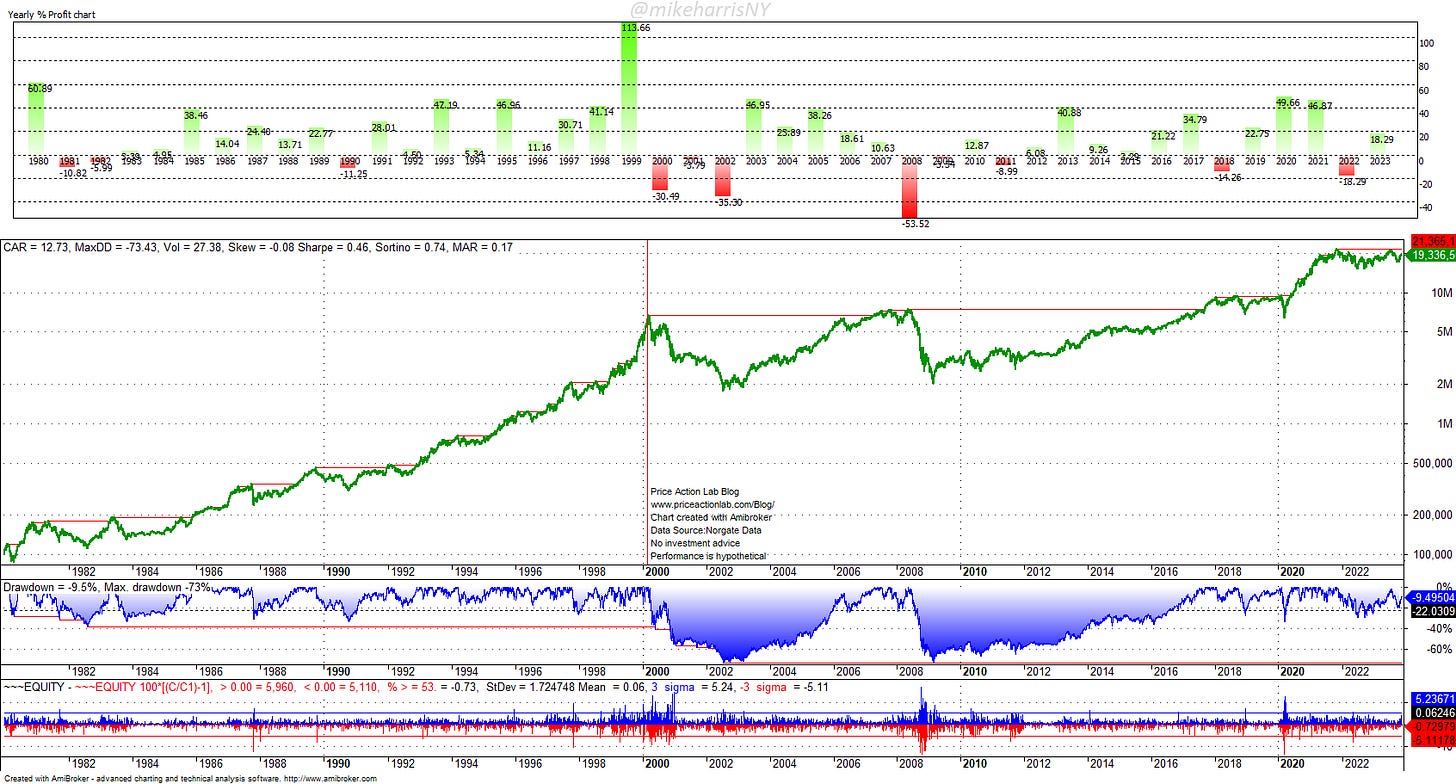

We could, for example, look at the 6-month performance to rank stocks. There is no material change from the original backtest.

Or, we could rebalance every six months, at the start of the year and at the end of June.

In all cases above, we find that momentum was strong until 1999, and then it started fading out. Momentum is not what it used to be. There is always a regime change in the markets.

In the Price Action Lab Blog, we offer premium content that includes the weekly Price Action Lab Report and weekly systematic trading signals for ETFs and equities.

By subscribing, you have immediate access to hundreds of articles. Premium Articles and Market Signals subscribers have immediate access to all articles in the trader education section, and All in One subscribers have immediate access to all premium content, including more than 140 Premium Insights articles.

We also offer daily mean-reversion signals for SPY, QQQ, and ZN futures.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker Data provider: Norgate Data

If you found this article interesting, you may follow me on Substack and X.